Alpha Q – Rethink Alpha with

Symbiotic Quant Intelligence

Why 90% of Investors Fail?

The Seven Barriers to Stock Market Investing:

The Herd Trap

Following the crowd, buying at the peak of the hype and selling at the bottom of the panic.

The "Information to Price" Gap

Even professional investors often trade on news that high-frequency algorithms have already priced into the market.

Risk Discipline Negligence

Most investors focus on potential gains while ignoring the “risk of ruin” that can wipe out an entire account.

The Lizard Brain Behavior

Fear and greed often turn rational investors into emotional gamblers.

The Market Timing Illusion

Attempting to “time the market” leads to high execution friction, missed opportunities, and fail to recognize regime changes

Self-Confirmation Bias

Investors tend to cherry-pick data that supports their beliefs while ignoring the hard evidence that says they’re wrong.

Signal vs. Noise

Drowning in massive amounts of quantitative data makes it nearly impossible to distinguish a real trend from random market “noise.”

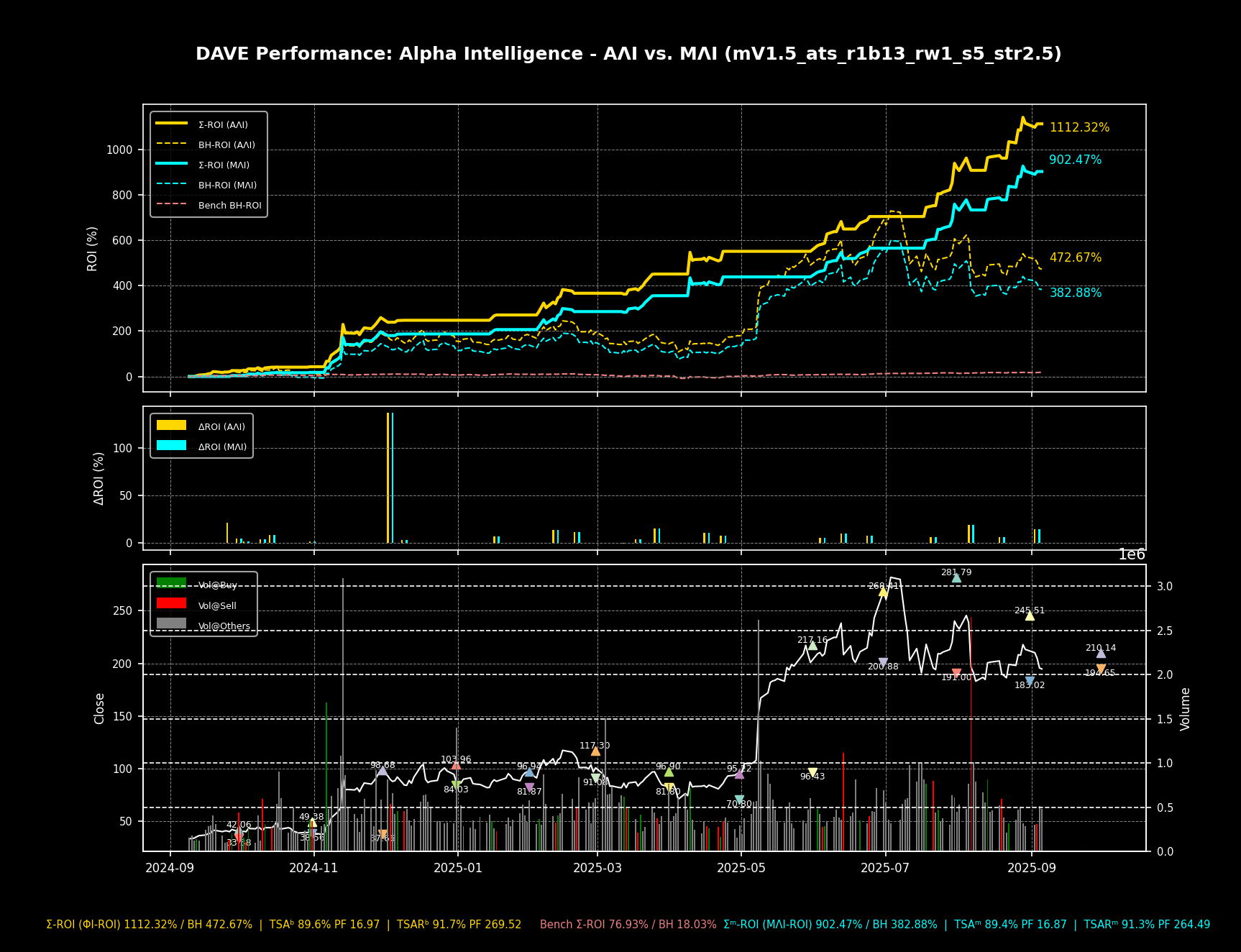

Amplyfying ROI (1,112.32%) with Algorithmic Quant Intelligence

Alpha Q Intelligence – Adaptive Market Intelligence System

Smarter Investing with Alpha Q

Alpha Q is a next-gen platform that augments expert human intelligence with

Quant Intelligence

Feature engineering

Human Expert + AI Intelligence augmented by Quantitative Model Reasoning

Algorithmic Discovery Engine

No More Sentiment or Psychological Biases for Market Timing

Smarter, more explainable, high-performance trading decisions

Alpha Q transforms market uncertainty for alpha opportunities by harnessing the power of Algorithmic Intelligence Engines and expert-driven Quantitative Intelligence (Algorithmic Quant Intelligence).

How it works?

Human expert provides curated data loop, feature engineering, and feedback to train machine learning for continuous improvement.

Algorithmic discovery model explores trading strategies, and improves trading accuracy via reinforcement learning

System adapts strategies to live market conditions to produce dynamic, transparent, explainable trading signals with hyperparamter optimization.

"Hallucination" Loopholes

AI‑driven sentiment analysis can rapidly scan news, social media, corporate filings, and event streams to gauge market mood. These models excel at extracting tone and contextual cues, helping investors anticipate how narratives may influence price action.

Yet Large Language Model sentiment engines often fall into predictable traps: they average out conflicting signals, flatten multidimensional risk factors, and occasionally hallucinate—missing critical “fatal‑risk” disclosures or assigning an unjustified neutral‑positive score. The result is sentiment that feels polished but produces misleading alpha.

Symbiotic Quant Intelligence architecture transforms subjective sentiment into a verifiable, testable trading factor. Qualitative insights are stress‑tested against quantitative filters, ensuring that hallucinations, emotional noise, and narrative distortions are mathematically filtered out. Investors gain the ability to capitalize on market psychology without sacrificing analytical rigor, enabling sentiment‑driven strategies that are both adaptive and grounded in measurable reality.

algorithmic Intelligence

An algorithm is essentially a set of step- by-step instructions or rules designed to solve a problem or perform a task or to simulate natural phenomenon, which guides a computer or other system on how to process information and make decisions.

Algorithmic Intelligence can quickly process vast datasets in real time, identifying patterns and trends that may elude human analysts.

Curated machine learning models are employed to analyze price movements, patterns, volatility, and various indicators without biases, and optimize parameters for Quant Intelligence.

Research has demonstrated that machine-augmented models can outperform traditional methods in forecasting market trends, thereby aiding investors in making more informed decisions.

trading Navigator

Alpha Q trading engine acts as a curated trading navigator, aligning every decision with your investment goals, risk tolerance, and preferred strategies.

Instead of relying on generic sentiment scores or static rules, it continuously analyzes market signals and adapts to changing conditions—much like a GPS that reroutes in real time. This ensures your portfolio stays aligned with your long‑term objectives while remaining responsive to short‑term market dynamics.

The engine blends qualitative insights with quantitative validation from price action, liquidity flows, volatility regimes, and earnings quality. This symbiotic loop transforms subjective sentiment into a measurable, testable trading factor.

When narratives shift or market structure changes, the engine automatically recalibrates exposure, tightens risk, or pauses trades to keep you on the most efficient path.

By balancing narrative intelligence with mathematical discipline, the QI trading engine delivers sentiment‑aware strategies without falling to hype, hallucination, or herding behavior. It gives investors a dynamic, risk‑aware navigation system that turns complex market signals into clear, validated, and actionable decisions.

Curated QI Investment

Alpha Q Navigator

Enhanced Data Analytics and Prediction Modeling

Analyze Market Movements with Quant Intelligence Machine Learning

Curated Modeling and Investment Portfolio Strategy

Risk Management

Intelligent Risk Management

Simulate various market scenarios to mitigate potential losses

AI risk management to Implement effective risk exposure and mitigation strategies

Validate market regimes with Quant Intelligence engine for strategic confidence and risk-mitigation

Peace of Mind with

Smarter-investing

Alpha Q Intelligence

Benefits of QI Investment Solutions

- Real-Time Data Analysis, Feature Engineering, and Execution: Harness machine intelligence for fast, accurate market analysis and optimal trade execution.

- Multi-Factor Analysis: Resolve conflicting market signals with QI-powered insights that weigh multiple indicators for risk-aligned decision-making.

- Scalable Solutions: Access professional-level trading operations without Herd Mentality.

- Emotion-Free Investing: Ensure objective, data-driven decisions free from emotional biases

- Curated Investment Strategies: Implement tailored strategies, from trend-following to arbitrage, with seamless algorithmic automation.