QI Blog

LFMD Case: Navigating Alpha Excess Returns with Algorithmic Intelligence

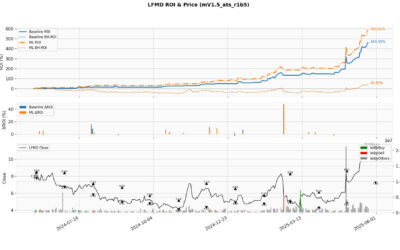

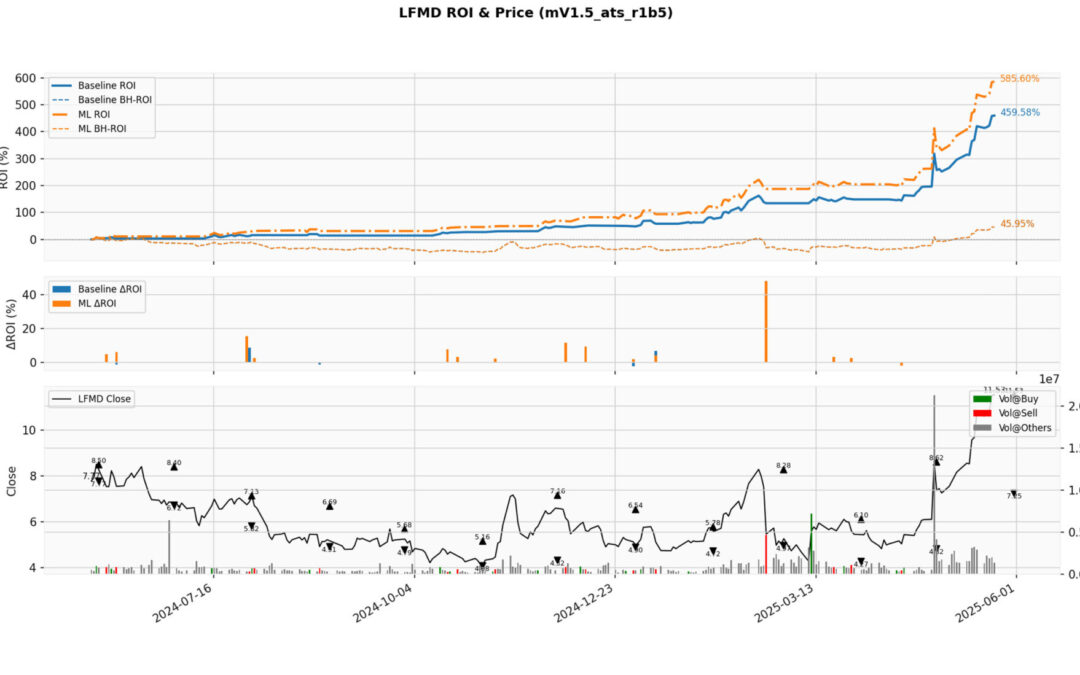

This case study illustrates the transformative power of the Laze Q platform, a peace-of-mind investing solution powered by Alpha Q Intelligence. Laze Q stands for Liberated, Algorithmic-Driven, Zero-Stress, Effortless Investing, enabling investors to maximize returns with intelligent risk mitigation strategy. Using LFMD (LifeMD, Inc.) as a test case, the platform demonstrates its core value: resilient strategic alpha generation amidst extreme volatility.

• Buy-and-Hold ROI: 45.95%

• Laze Q Baseline Algorithmic Intelligence ROI: 459.58%

• Laze Q + Machine Learning Layer ROI: 585.60%

While the underlying stock exhibited sharp drawdowns and recoveries, the platform intelligently navigated volatility, delivering superior returns with multi-dimensional risk mitigation and adaptive trading intelligence.

How Alpha Intelligence Performs in Different Market Regimes?

At its core, Alpha Intelligence leverages a symbiotic relationship between human expert insight and advanced quantitative intelligence, augmenting human decision-making with logical and quantitative reasoning over vast amounts of structured and unstructured data26. This sophisticated platform combines two distinct, yet complementary, trading engines:

1. ΑΛΙ (Algorithmic Lambda Intelligence): This is an algorithmic discovery engine for algorithmic intelligence. It acts as a logical formulation engine designed to analyze and respond to stock market data with precision. ΑΛΙ excels at identifying and capitalizing on clear, consistent market trends.

2. ΜΛΙ (Quant Intelligence with ML Layer): This is an adaptive engine that has been trained from ΑΛΙ’s rules and constraints, and incorporates machine learning flexibility. ΜΛΙ continuously improves and adjusts to market volatility, acting as a powerful risk manager and return compounder in chaotic conditions.

Together, these engines form a dual-layer approach that ensures Alpha Intelligence always has a winning strategy, adapting its strategies to live market conditions with intelligent risk mitigation.

LFMD Case: Navigating Alpha Excess Returns with Algorithmic Intelligence

This case study illustrates the transformative power of the Laze Q implementation, a peace-of-mind investing solution...

How Alpha Intelligence Performs in Different Market Regimes?

Tired of Market Volatility Draining Your Portfolio? Discover How Alpha Q Labs' Intelligent System Generates Alpha in...

Candlestick Patterns

This video provides an in-depth guide to understanding and using candlestick patterns for successful trading. Key...

Symbiotic Quant Intelligence To Redefine AI-Powered Investing

The integration of artificial intelligence in stock trading has transformed how market data is analyzed and utilized....

LFMD Case: Navigating Alpha Excess Returns with Algorithmic Intelligence

This case study illustrates the transformative power of the Laze Q platform, a peace-of-mind investing solution powered by Alpha Q Intelligence. Laze Q stands for Liberated, Algorithmic-Driven, Zero-Stress, Effortless Investing, enabling investors to maximize returns with intelligent risk mitigation strategy. Using LFMD (LifeMD, Inc.) as a test case, the platform demonstrates its core value: resilient strategic alpha generation amidst extreme volatility.

• Buy-and-Hold ROI: 45.95%

• Laze Q Baseline Algorithmic Intelligence ROI: 459.58%

• Laze Q + Machine Learning Layer ROI: 585.60%

While the underlying stock exhibited sharp drawdowns and recoveries, the platform intelligently navigated volatility, delivering superior returns with multi-dimensional risk mitigation and adaptive trading intelligence.

How Alpha Intelligence Performs in Different Market Regimes?

At its core, Alpha Intelligence leverages a symbiotic relationship between human expert insight and advanced quantitative intelligence, augmenting human decision-making with logical and quantitative reasoning over vast amounts of structured and unstructured data26. This sophisticated platform combines two distinct, yet complementary, trading engines:

1. ΑΛΙ (Algorithmic Lambda Intelligence): This is an algorithmic discovery engine for algorithmic intelligence. It acts as a logical formulation engine designed to analyze and respond to stock market data with precision. ΑΛΙ excels at identifying and capitalizing on clear, consistent market trends.

2. ΜΛΙ (Quant Intelligence with ML Layer): This is an adaptive engine that has been trained from ΑΛΙ’s rules and constraints, and incorporates machine learning flexibility. ΜΛΙ continuously improves and adjusts to market volatility, acting as a powerful risk manager and return compounder in chaotic conditions.

Together, these engines form a dual-layer approach that ensures Alpha Intelligence always has a winning strategy, adapting its strategies to live market conditions with intelligent risk mitigation.

Candlestick Patterns

This video provides an in-depth guide to understanding and using candlestick patterns for successful trading. Key topics covered include: Candlestick Basics [01:46]: The video starts with a quick recap of how to read candlesticks, including identifying bullish (green)...

Symbiotic Quant Intelligence To Redefine AI-Powered Investing

The integration of artificial intelligence in stock trading has transformed how market data is analyzed and utilized. Among AI technologies, Large Language Models (LLMs)—such as OpenAI’s GPT series, Gemini and Claude —have attracted attention for their natural language processing capabilities. However, while LLMs are powerful for interpreting and optimizing financial text, they fall short in deep data-driven stock market analysis.

For AI-powered stock trading, the key isn’t just understanding news sentiment and optimizing context —it’s about executing precise, data-driven strategies with real-time adaptability and quantitative intelligence. That’s where Symbiotic Quant Intelligence (SQI) emerges as a superior approach, combining machine-driven speed with expert domain insights to refine decision-making.

Unveiling the Edge of Algorithmic Intelligence – Performance Metrics

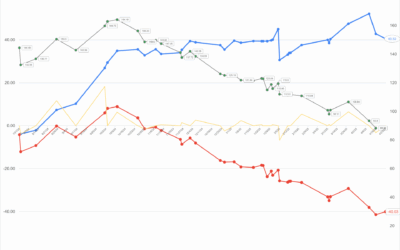

The QI-model’s behavior reveals a sophisticated trading strategy:

Loss Mitigation: The model attempts to limit losses during downturns by reacting to sell signals, although it may not completely avoid all losses due to factors like signal and execution delays.

Rebound Capture: The model prioritizes capturing gains from trend reversals. It aims to identify potential bottoms and generate timely buy signals to capitalize on rebounding momentum. This strategy focuses on capturing significant market moves rather than perfectly timing every peak and trough.

Dynamic Adaptation: The QI-model dynamically adapts to changing market conditions, adjusting its positions and trading decisions in response to new information.

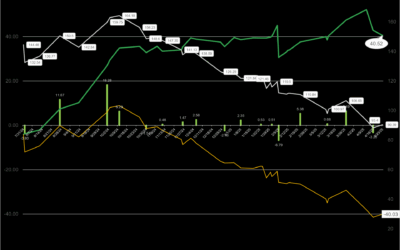

Alpha Q: Unlocking Alpha Excess Returns Through Intelligent Risk Mitigation

Alpha Q demonstrates that well-trained machine learning models, structured with an algorithmic discovery engine, curated data, and hyperparameter optimization, can consistently deliver alpha even in hostile market conditions. Its adaptive signal logic, combined with real-time risk calibration, makes it an advanced tool for institutional and sophisticated investors. Alpha Q isn’t just smart — it’s battle-tested. While AMD fell 37% in a bearish market, Alpha Q delivered a +40.52% return using precision signals powered by advanced machine learning.

Alpha Q

- Quant & Algorithmic Intelligence

- Symbiotic Learning

- Algorithmic Discovery Engine

- Reduce Psychological Biases in Market Timing

- Improving Security Selection

- Mitigate Risk and Information Asymmetry

- Generating Alpha During a Bearisk Market Downturn