This case study illustrates the transformative power of the Laze Q implementation, a peace-of-mind investing solution powered by Alpha Q Intelligence. Laze Q stands for Liberated, Algorithmic-Driven, Zero-Stress, Effortless Investing. It enables investors to maximize returns while minimizing risk with intelligent risk mitigation. Using LFMD (LifeMD, Inc.) as a test case, the platform demonstrates its core value: resilient strategic alpha generation amidst extreme volatility.

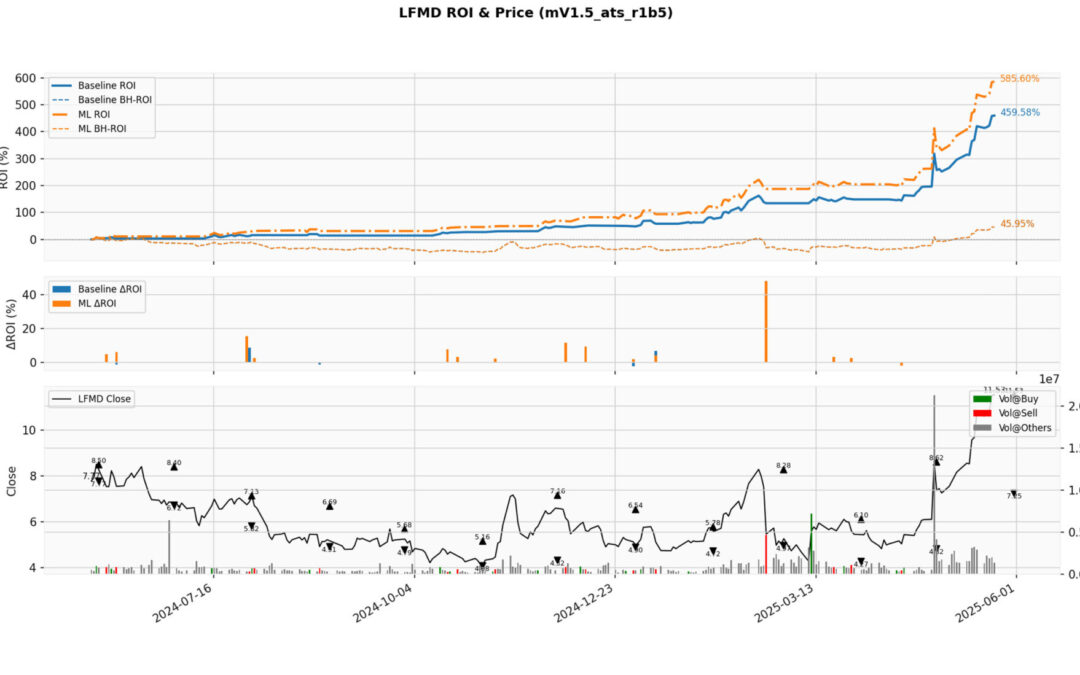

- Buy-and-Hold ROI: 45.95%

- Laze Q algorithmic intelligence ROI as Baseline: 459.58%

- Laze Q + Machine Learning Layer ROI: 585.60%

While the underlying stock exhibited sharp drawdowns and recoveries, the platform intelligently navigated volatility, delivering superior returns with multi-dimensional risk mitigation and adaptive trading intelligence.

Company Profile: LifeMD (LFMD)

LifeMD, Inc. is a U.S.-based telehealth platform focused on delivering direct-to-consumer healthcare services. Founded in 1987 and rebranded in recent years, LifeMD operates in a high-growth sector offering virtual consultations, diagnostics, and prescription delivery.

Products & Services:

- Telehealth for primary and chronic care (subscription-based)

- Men’s and women’s health, dermatology, and allergy services

- Diagnostic testing and lab services

- Prescription management and delivery

Target Market:

- Cost-conscious consumers seeking convenient virtual care

- Uninsured or underinsured populations

- Patients seeking discreet and accessible wellness services

Analyst Ratings:

- Generally rated as speculative growth with high upside potential

- Mixed analyst sentiment due to volatility, limited earnings, but strong sector tailwinds

Challenges & Opportunities:

- Revenue growth remains solid, but profitability lags

- High volatility due to earnings misses and speculative interest

- Telehealth sector expected to grow at CAGR ~18% through 2030

Market Behavior vs. Laze Q Performance

The underlying price action of LFMD during the covered period (mid-2024 to mid-2025) was erratic and unpredictable:

- Initial rise from $7.77 to $8.40

- Sharp decline to $4.52

- Recovery to $8.28

- Drawdown to $4.12

- Explosive rally to $11.53

These fluctuations typically challenge emotional investors and render manual strategies ineffective or overly risky. Yet, Laze Q’s layered intelligence mechanisms enabled data-informed, algorithmic entries and exits with intelligent risk mitigation, avoiding reactive decisions and capitalizing on statistical signals.

Strategic Alpha Delivery via Laze Q

Strategy | ROI (%) | Description |

Buy and Hold | 45.95 | Passive holding of the security over the full period |

Laze Q Baseline Strategy | 459.58 | Signal-driven, emotion-free algorithmic execution |

Laze Q ML-Augmented ROI | 585.60 | Incorporates adaptive learning and multidimensional risk signals |

Insights:

- The baseline algorithm intelligence already outperformed buy-and-hold by 10x, affirming the robustness of signal-driven investing.

- The machine learning layer augmented Quant Intelligence dynamically adjusted exposure, fine-tuned entries/exits, and further increased ROI by ~126% over the baseline.

ΔROI Analysis:

- The model shows spikes in ΔROI during transitional phases—where manual investors often hesitate or exit prematurely.

- These bursts of incremental return (ΔROI) are nonlinear and opportunity-optimized, not dependent on broad trend following.

The Peace-of-Mind Paradigm: What Makes Laze Q Unique?

- Liberated from the need to monitor tickers or interpret financial news

- Algorithmic decisions based on multi-layered quantitative indicators

- Zero-Stress required from the user—execution is automated, stressless

- Effortless ROI via embedded intelligence that thrives under volatility

In the words of Darwin, “It is not the strongest that survives, but the most adaptable.” Laze Q is the embodiment of that adaptability in modern markets—evolving, learning, and outperforming.

Navigating Strategic Alpha Without Anxiety

LFMD’s case is not an outlier but a demonstration of what Laze Q can do in high-volatility, high-potential growth stocks. The combination of algorithmic discipline and adaptive machine intelligence offers not only superior returns but also peace of mind.

As markets grow more volatile and less forgiving, Laze Q emerges as a new approach for intelligent investing with refined peace of mind —freeing the investor from decision fatigue while unlocking next-level alpha.