The integration of artificial intelligence in stock trading has transformed how market data is analyzed and utilized. Among AI technologies, Large Language Models (LLMs)—such as OpenAI’s GPT series, Gemini, and Claude—have gained traction for their natural language processing capabilities. These models excel at interpreting financial text, summarizing reports, and analyzing sentiment. However, their ability to conduct deep quantitative market analysis remains limited.

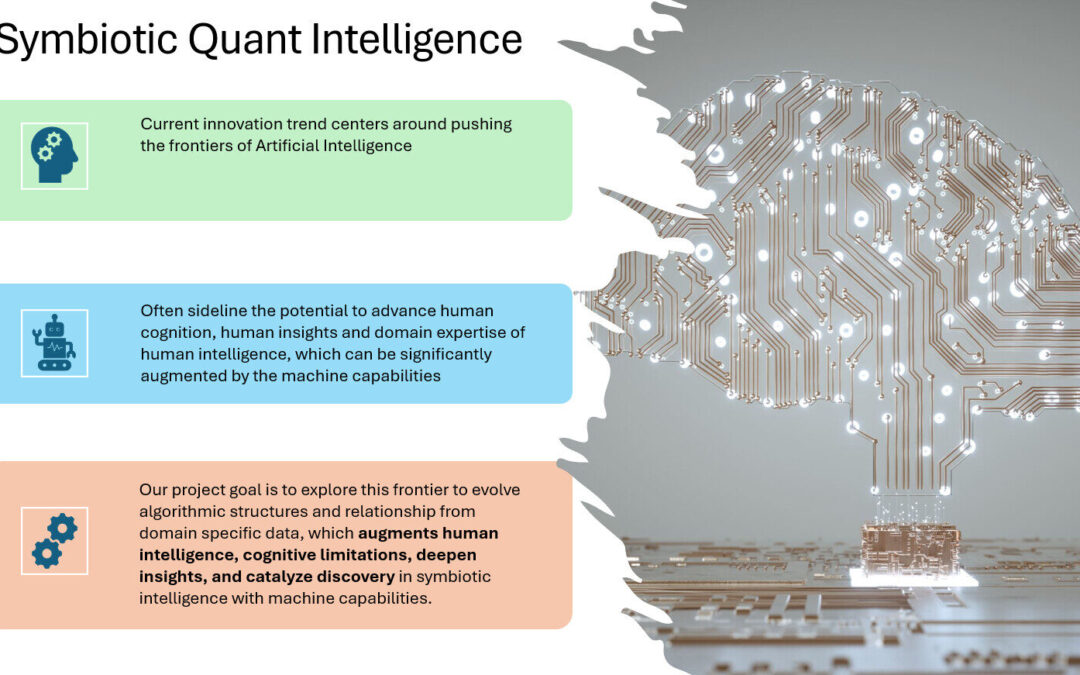

Stock trading requires more than text-based insights. It demands real-time adaptability, quantitative precision, and interpretation over structured and unstructured data with expert intuition. This is where Symbiotic Quant Intelligence (SQI) emerges, integrating algorithmic models with domain expertise to refine decision-making.

The Role and Limitations of LLMs in Stock Trading

LLMs provide unique advantages in financial analysis, such as:

✅ Sentiment Analysis: Extracting insights from financial news, earnings calls, and market sentiment.

✅ Natural Language Interpretation: Simplifying complex financial reports and assisting with market commentary.

✅ Automated Research: Summarizing macroeconomic trends and identifying industry shifts.

Despite these strengths, LLMs face notable limitations in executing multi-dimensional market-driven trading strategies:

1️⃣ Designed for Language, Not Quantitative Analysis

• LLMs primarily process and generate text with optimization, rather than conduct intricate numerical computations.

• While they can interpret financial concepts, they lack the ability to diagnose price and market movements dynamically or execute trading with algorithmic rigo.

2️⃣ Limited Real-Time Market Adaptation

• LLMs rely on historical and static training data, making them less effective in adjusting predictions based on evolving market dynamics.

• Stock trading demands continuous data ingestion, which traditional LLMs struggle to achieve without extensive external integration and domain expertise.

3️⃣ Challenges with Complex Market Indicators

• While LLMs can describe technical indicators (e.g., MACD, Bollinger Bands), they do not inherently process and optimize them for predictive modeling when they face conflicting signals.

• Effective trading requires real-time signal refinement and decisions for priority, which LLMs alone cannot provide.

4️⃣ Numerical Computation Constraints

• While LLMs can perform basic calculations, they are not optimized for advanced machine learning models, such as time-series forecasting with multi-dimensional data or risk-adjusted optimization.

• Predictive trading requires AI models capable of mathematical reasoning beyond natural language comprehension.

5️⃣ Potential for Misinterpretation

• LLMs generate plausible-sounding responses based on probability and optimization of context, sometimes producing incorrect financial conclusions.

• In stock trading, precise data interpretation is critical—small errors can lead to significant financial losses.

The Symbiotic Quant Intelligence (SQI) Approach

SQI offers a more balanced and complementary approach with machine intelligence, integrating machine efficiency with domain expertise to ingest market dynamics with trading strategies.

🔹 Augments Expertise

• Harmonizes expert intuition with algorithmic intelligence models, leveraging quantitative intelligence to refine decision-making

• Unlike purely automated models, SQI incorporates human insights, ensuring adaptability in complex market conditions over structured and unstructured dataset.

🔹 Ensures Transparency

• Uses explainable AI frameworks, providing clarity into why signals are generated, unlike LLM based black-box models.

• Investors gain confidence in interpretable risk assessments and trade execution rationales.

🔹 Optimizes Performance

• Identifies uncorrelated alpha, continuously refining strategies to maximize returns and manage risk dynamically.

• Machine learning adapts to shifting trends, improving performance without emotional biases.

🔹 Minimizes Emotional Trading Biases

• SQI eliminates decision paralysis, reducing hesitation, panic-selling, and market overreaction.

• Helps investors focus on data-driven algorithmic intelligence trades, rather than reacting emotionally to volatility.

Balancing AI Approaches in Stock Trading

While LLMs provide valuable insights, they work best as supplementary tools—helping investors understand financial news, extract key narratives, and monitor sentiment shifts. However, they are not substitutes for specialized AI models designed for quantitative trading.

SQI bridges the gap, combining the precision of numerical analysis with real-time adaptability, ensuring that algorithmic efficiency and expert reasoning complement each other.

For investors seeking data-driven clarity, continuous optimization, and reduced emotional trading risks, Symbiotic Quant Intelligence offers a refined, adaptable approach—going beyond language-based AI models in trading applications.

In summary, both LLMs and Symbiotic Quant Intelligence play roles in financial analysis—but their ideal use cases differ. LLMs excel at text-based insights and contextual optimization, while SQI delivers structured, adaptive, risk-managed strategies for high-precision investing with algorithmic rigor.

Investors and AI developers should leverage both technologies strategically—using LLMs for research and sentiment while deploying SQI for deep quantitative execution. The most effective trading systems blend these technologies, ensuring robust decision-making in an evolving financial landscape.