How QI-Powered Algorithmic Modeling Is Transforming Trading

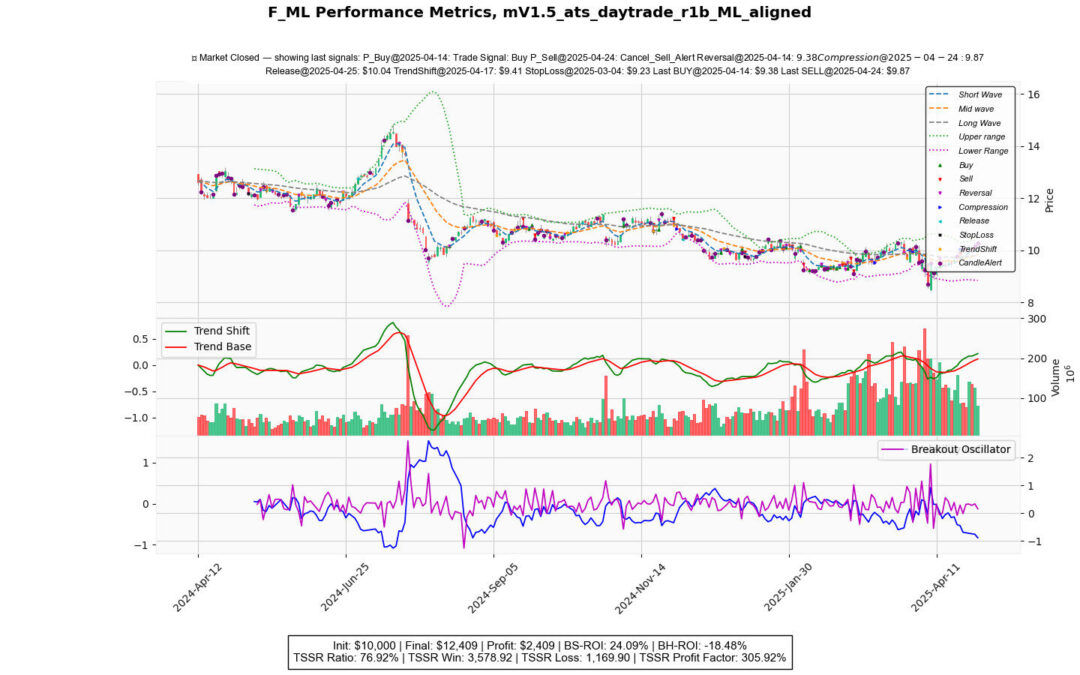

For many investors, the stock market presents a paradox: immense profit potential coexists with significant risks of underperformance, especially in the case of low-volatility or underperforming stocks. Consider F, known as a good dividend stock but not typically seen as a high performer. During the analyzed period, if you had simply held this stock, the BH-ROI metric reveals you would have incurred a -18.48% loss. However, QI-navigated machine learning models, as represented in the chart, demonstrate how even an ordinary stock like this can deliver extraordinary results with the right tools.

Understanding the Stock’s Challenges

The BH-ROI, which reflects the performance of a passive “buy-and-hold” strategy, highlights the challenges of relying on traditional methods with this stock. Although many traders might believe that holding for the long term is a safe bet, the data indicates otherwise. Over the analyzed period, holding this stock resulted in a -18.48% loss — a sobering reality for long-term investors reliant solely on traditional approaches for dividend stocks. This underscores the importance of incorporating smarter trading strategies, particularly for stocks with low growth or high volatility. Passive approaches fail to account for market dynamics, whereas AI-powered proactive, machine learning-driven strategies adapt to these nuances.

Technical Indicators and Market Volatility

The chart showcases several indicators, providing key insights into the stock’s price action and volatility, such as trading volume, candlestick patterns, various momentum, trend shift and breakout indicators, and more. Although these indicators offer valuable insights, they remain subject to human interpretation and can lead to false signals when used in isolation. This is where alpha Q’s advanced modeling steps in to bridge the gap.

QI Algorithmic Reinforced Trading: A Game-Changer

One of the standout features is the algorithm discovery engine, representing how the model processes numerical data movements and volatility, continuously learning from these patterns and market dynamics. Unlike traditional trading models, ML-augmented systems leverage purpose-driven algorithms and reinforcement learning processes for continuous improvement. They analyze various trends, short-term and long-term price and motion dynamics, volatility, and fundamentals — all without emotional biases. The model generates a chart that functions as an AI-enhanced investment navigator by combining this predictive power with indicators. This integration of machine learning ensures:

- Faster and continuous identification of opportunities to catch how the market reacts.

- Minimization of false signals by cross-verifying predictions with multiple indicators.

- Adaptive learning to new market conditions, learning from trends and live data.

Extraordinary Results From an Ordinary Stock

The results are self-evident. The ML based ROI metric, which measures the performance of Alpha AI’s algorithmic navigator model, shows an astounding 24.09% return on investment during the same period.

This represents a drastic turnaround from the -18.48% loss to a consistent profit, highlighting the model’s ability to unlock the hidden potential in underperforming stocks while mitigating the risks during the downturn. Here’s how this model achieves this:

- Progressive study algorithm: The model identifies the right moments to move, such as buy, sell, or hold through a pre-trained market navigator algorithm without relying on static assumptions of normal statistical distribution.

- Volatility Exploitation: Leveraging machine learning predictions, it capitalizes based on the predicted movements.

- Comprehensive Navigator: Combining fundamental and technical indicators with predictive analytics, the model provides a multi-layered view of the market, mitigating risks associated with single-strategy approaches.

The Future of Transformative Trading

This example is a testament to the transformative potential of AI-augmented QI algorithmic strategy with symbiotic intelligence. While traditional indicators like candlestick patterns, volume and price movements, moving averages, MACD, and Bollinger Bands provide valuable insights, they often require manual interpretation and are prone to human error, often leading to confusion or misjudgment due to conflicting signals. The expert-trained Machine Learning algorithm model, on the other hand, offers real-time, objective data-driven insights that adapt to changing market conditions with automated processes. For traders and investors, the implications are clear:

- Even low-performing stocks can potentially deliver attractive returns with the right strategy.

- QI algorithmic trading, reinforced by machine learning without emotional biases such as fear of loss, greed, and herd mentality, outpaces traditional approaches, especially in volatile markets.

- Machine learning models, like Alpha Q Navigator, are no longer a luxury—they are becoming essential tools for maximizing ROI in turbulent market conditions.

From Loss to Profit

This case study tells a compelling story: while traditional strategies could have resulted in significant losses, a well-trained machine-learning model designed for specific trading strategies turned this ordinary stock into an extraordinary opportunity. By harnessing the power of predictive analytics and combining it with proven technical indicators, traders can unlock the hidden potential of underperforming assets. As financial markets become increasingly complex, tools like Alpha Q will play a pivotal role in helping traders navigate uncertainty, exploit volatility, and achieve outstanding results.

Whether you’re a seasoned investor or a newcomer to the market, the message is clear: the future of trading lies in the synergy of human insight and machine intelligence.

Disclosure: “Investing involves risks, including the potential loss of principal. All information provided on this website is for informational purposes only and should not be considered financial advice, an offer, or a recommendation to buy or sell any securities or investments. Past performance is not indicative of future results. Please consult a licensed financial advisor, tax professional, or attorney to understand how this information applies to your individual circumstances.” See the important disclosure.