In today’s uncertain market environment, investors are demanding more than growth—they demand resilience.

Alpha Q, our pre-trained machine learning investment model, is delivering just that: consistent alpha and capital protection QI model, even during market declines.

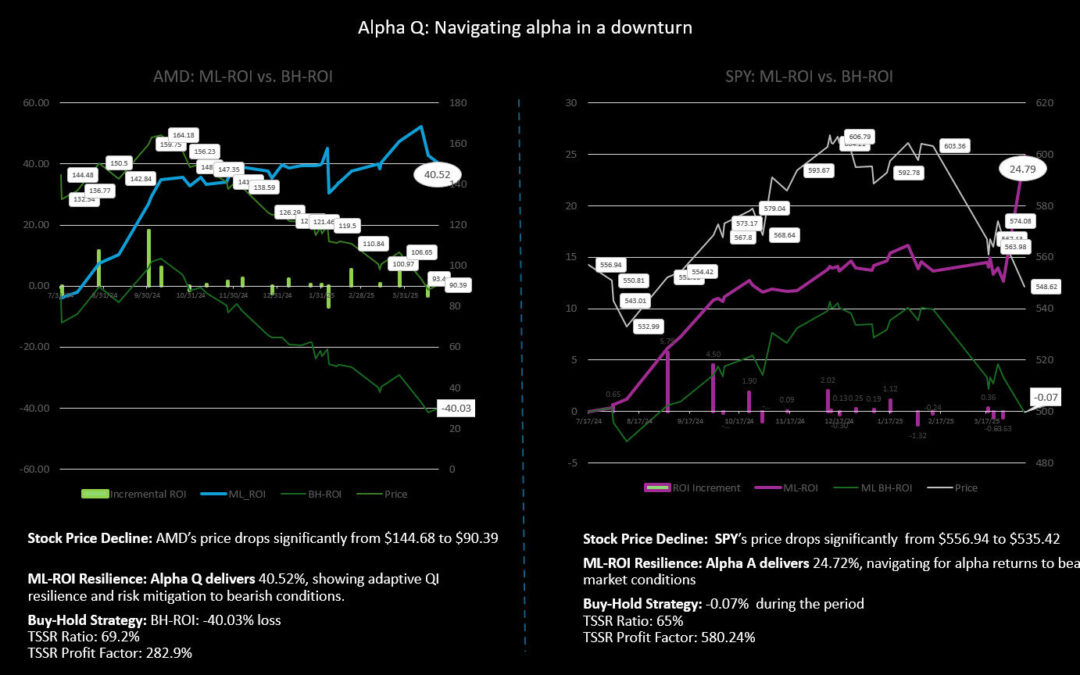

Recent real-world performance analyses using AMD and SPY as test cases provide compelling performance that Alpha Q is not just another model — it’s an adaptive, risk-aware alpha engine.

Dual Case Study: AMD vs SPY

We evaluated Alpha Q during a bearish cycle in two very different asset types:

Metric | AMD (High-Volatility Equity) | SPY (Broad Market ETF) |

Stock Price Decline | -37.5% | -3.8% |

ML ROI (Alpha Q) | +40.52% | +24.72% |

Buy-and-Hold ROI | -40.03% | -0.07% |

TSSR Ratio | 69.2% | 65% |

Profit Factor | 282.9% | 580.24% |

What These Results Prove

✅ Alpha Generation Is Consistent

Alpha Q didn’t just perform in a single environment. It generated positive ROI in both deep equity drawdowns and broader ETF corrections, signaling generalizability across asset classes.

🔍 Trade Accuracy & Risk Control

The TSSR Ratio shows that more than 2 out of 3 trades were profitable, and Profit Factor indicates that gains significantly outpaced any realized losses. SPY’s case, in particular, demonstrated extraordinary efficiency: Alpha Q extracted alpha from low-volatility environments without unnecessary exposure.

📉 Buy-and-Hold Underperforms

Even in a relatively stable ETF like SPY, Buy-and-Hold returned -.0.07%. In AMD, it would’ve meant a -40% loss. Alpha Q avoids these traps through dynamic entry and exit strategies grounded in adaptive machine learning protocol.

Investor Implications

Alpha Q is engineered for investors who are:

- Navigating volatile or sideways markets

- Seeking non-directional excess return streams

- Interested in risk-adjusted performance over speculative trades

- Allocating to AI-enhanced quant strategies across equities, pension funds, or ETFs

Whether you’re a family office, hedge fund, or platform integrator, Alpha Q offers a Symbiotic Quant Intelligence model for systematic alpha — validated in real market downturns.

If you’re ready to put capital behind performance that speaks for itself, contact our team.