Abstract: This report demonstrates the performance of Alpha Q, an adaptive machine learning (ML)-based trading system, during a bearish market cycle using AMD as a case study. The system outperformed traditional buy-and-hold strategies by leveraging high-confidence trade signals and dynamic risk management techniques. The analysis highlights Alpha Q’s unique capability to deliver alpha while systematically minimizing drawdown risks.

1. Market Backdrop: AMD Case Study

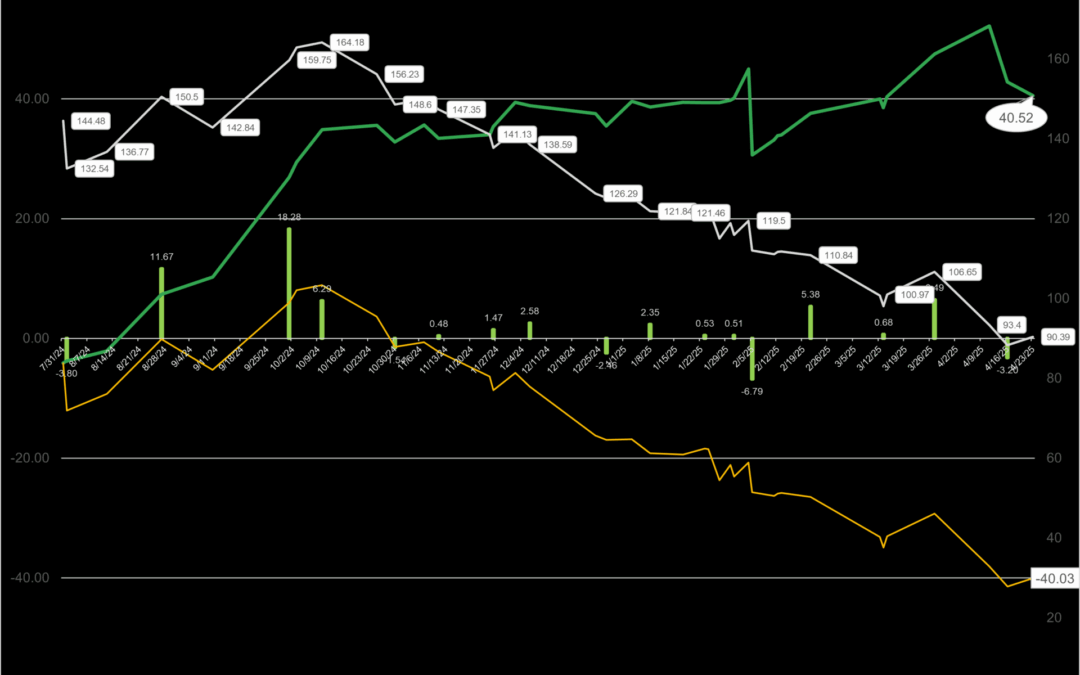

During the observed period, AMD experienced a drawdown from $144.68 to $90.39, reflecting a 37% decline in stock price. Traditional Buy-and-Hold (BH) strategies followed suit with a -40.03% ROI. Alpha Q, however, posted a +40.52% ROI, delivering an excess return of over 80 percentage points.

2. Performance Metrics

- ML ROI: +40.52%

- Buy-and-Hold ROI: -40.03%

- TSSR Ratio: 69.2%

- TSSR Profit Factor: 282.9%

These metrics illustrate Alpha Q’s precision in signal execution and its ability to translate market volatility into positive returns.

3. Methodology Overview

- Signal Generation: Alpha Q employs a proprietary blend of technical and statistical features engineered to detect market shifts, breakouts, and market inefficiencies.

- Pre-Trained ML Model: Adaptively responds to regime shifts without overfitting

- Execution Logic: Capital allocation based on signal confidence; exits based on trailing-stop, reversal, or volatility thresholds

4. TSSR & Profit Factor Explained

- TSSR Ratio measures the ROI improvement per trade, including both buy and sell trades. It captures the model’s ability to detect profitable entries and protect capital by identifying bearish conditions early, making it an effective risk mitigation metric. However, TSSR does not directly represent signal accuracy in a traditional sense — it simply quantifies how much each executed trade improved ROI.

- Profit Factor compares the total gross profit to the total gross loss across all trades. It is a critical indicator of the efficiency and contribution of trades to portfolio performance.

Together, TSSR and Profit Factor offer a multidimensional view of strategy effectiveness — TSSR reflecting trade-level contribution to ROI, and Profit Factor capturing the system-wide profit-to-loss efficiency. Combining the two helps assess both the execution quality and capital efficiency of the Alpha Q system.

“It’s not the strongest of the species that survives, nor the most intelligent, but the one most responsive to change.” — Attributed to Charles Darwin

In markets, as in nature, survival hinges not on brute force or intelligence alone but on the capacity to adapt. Alpha Q exemplifies this evolutionary principle. By constantly recalibrating to market conditions and managing risk proactively, the model increases its probability of long-term survival and outperformance — preserving capital when others falter and capturing gains when opportunities arise.

5. Strategic Implications

Alpha Q is designed for investors seeking:

- Risk-adjusted alpha in volatile markets

- Tactical, non-directional strategies

- Proactive algorithmic trade execution, avoiding emotional bias

It bridges the gap between traditional fundamental investing and modern algorithmic quant intelligence.

Conclusion: Alpha Q demonstrates that well-trained machine learning models, structured with an algorithmic discovery engine, curated data, and hyperparameter optimization, can consistently deliver alpha even in hostile market conditions. Its adaptive signal logic and real-time risk calibration make it an advanced tool for institutional and sophisticated investors. Alpha Q isn’t just smart — it’s battle-tested.