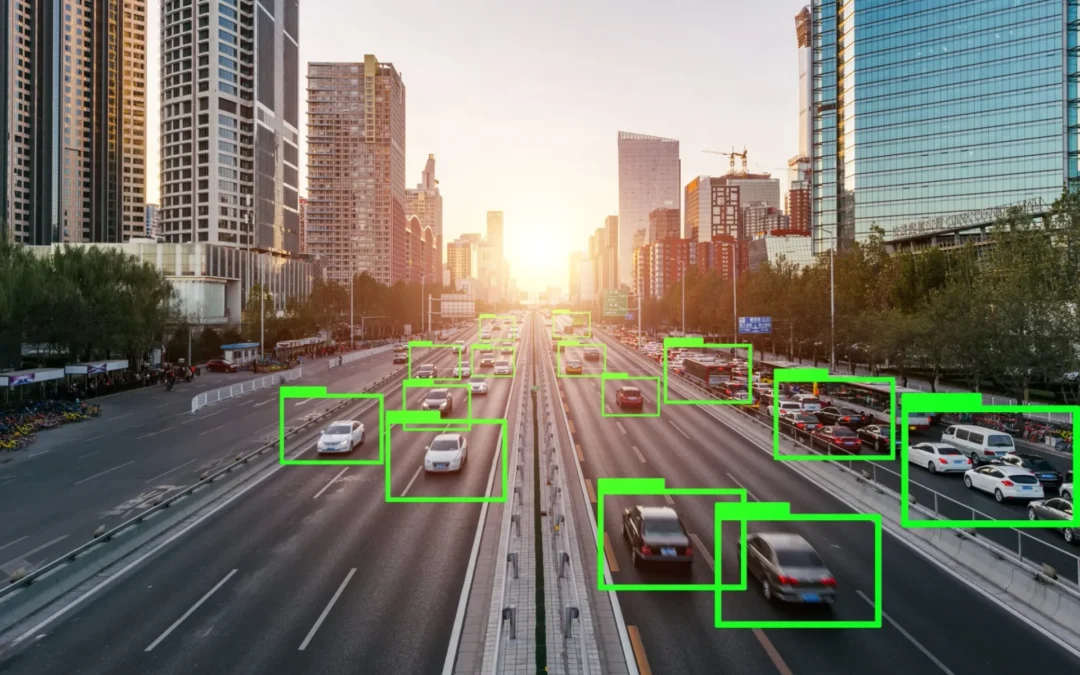

by Editor | Nov 18, 2024 | Data Labeling, Risk of AI trading systems

Data labeling is a critical step in training AI systems as it ensures that machine learning models learn from accurately labeled datasets. However, there are significant risks and quality assurance (QA) issues associated with data labeling, especially when these tasks...

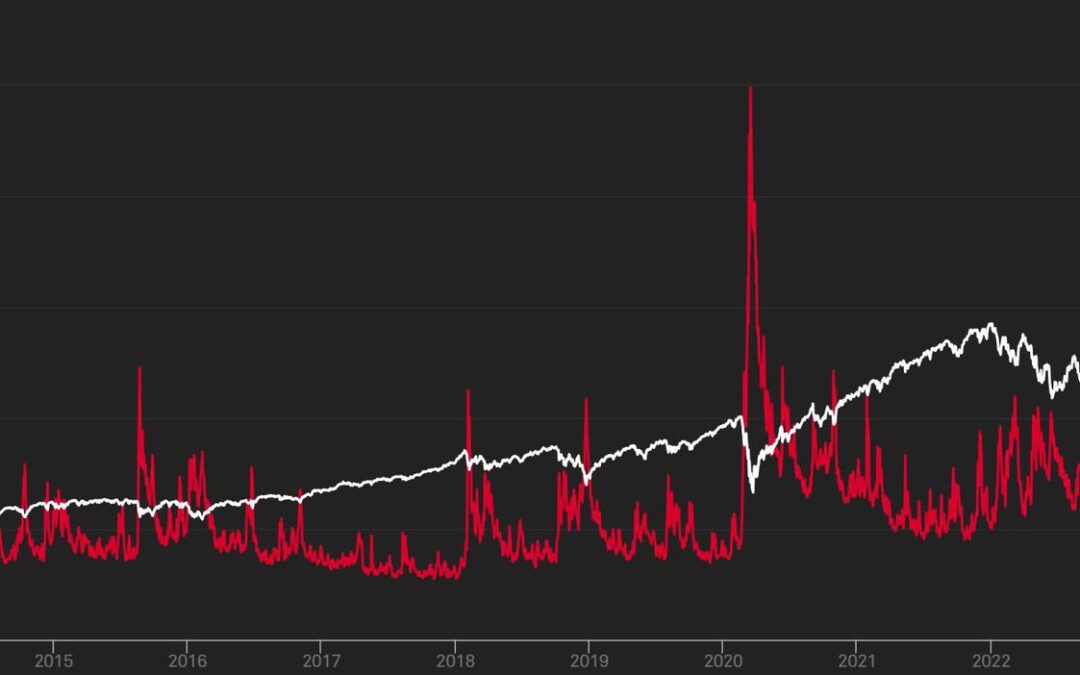

by Editor | Nov 18, 2024 | Automated Trading, Risk of AI trading systems

Trading indicators are essential tools in technical analysis, helping traders interpret market data and make informed decisions. While indicators such as moving averages, candlestick patterns, Fibonacci retracements, MACD, TTM Squeeze, Markov chains, and ATR provide...

by Editor | Nov 16, 2024 | Automated Trading

The Benefits of Algorithm-Based Automated Trading Strategies The stock market is fast-paced, data-driven, and often emotionally charged. For investors and traders alike, analyzing complex technical indicators and conflicting signals daily can be overwhelming, leading...

by Editor | Nov 16, 2024 | Sentimental Analysis

Revolutionizing Sentiment Analysis in the Stock Market with AI-Powered Predictive Modeling In the high-stakes world of stock trading, accurate and timely information is paramount. The financial markets are driven not only by numbers but by emotions, perceptions, and...

by Editor | Nov 11, 2024 | Backtesting

How AI-Driven Backtesting is Revolutionizing the Refinement of Algorithmic Trading Strategies? Algorithmic trading has transformed the financial markets by automating trade execution and enabling faster, data-driven decisions. However, the true power of algorithmic...